It’s so good to be back in touch with you. It’s been a while since we’ve been together but it was good times back then at Bob Allen’s house. I’m looking forward to it.

Bob Allen‘s a mutual friend and mentor to us. Do you want to share a little bit about Bob? What is it about Bob, his investment strategy, his writing strategy or his presence or whatever that attracted you to working with him to being in his world?

Bob is a good communicator. If you haven’t had a chance to read any of his books, hear him speak or be in one of his groups where he teaches you what he knows about communication, then you need to step up. Make the effort to either read one of his books or spend some time with Bob. He’s an incredible person. He’s such a motivational person to see what he’s done in his own life and he’s so humble about sharing what he knows with other people.

You started as a doctor. It’s Dr. Tom McFie and now you’re doing all this finance stuff. How did that end up happening?

I was a doctor for twenty years in private practice. I had owned four different clinics in three different states. I kept being frustrated with the people that I hired to manage my money. It always seemed like they were making more off of me than I was making off their advice and their recommendations. It wasn’t until 2004 when we were robbed. A letter from a colleague showed up on my desk as we were sorting through the mess of the robbery. This letter said, “You need to investigate how I save $30,000 in taxes last year.” I’d read that letter about eighteen months before and it got filed. Michelle, my wife, said, “Tom, have you checked into this?” I said, “No.” She says, “I want you to.” That’s how I got involved in how to manage my own money so that I was able to keep the fees that I was paying everyone else to manage my money for myself.

That was some horrible, traumatic situation. A robbery, which is a violation, ends up being a huge gift for you because it was the gateway for you into this whole area of investing and setting up Infinite Banking.

Money that flows creates more wealth in your life. Share on XThat would have never happened had we not decided to go through the things that the robbers didn’t take and reevaluate, “If they didn’t take it, what worth is it to us to keep it?” We did a lot of purging at that time too because a lot of people think that wealth is money or wealth is the materialistic things that we can buy. That couldn’t be further from the truth. Wealth is the relationships that you build with other people. It’s the interaction that you have, the value that you create in other people’s life. When we get our mind off fixed around what money is and isn’t, then most of the things in our life get fixed too.

You ended up purging quite a lot out of that robbery?

We did and in that purging, we left a spot for us to realize that we could become our own manager, we could become our own bank. We didn’t have to trust the financial planners and the financial institutions of the world that seem to be taking more from us than we ever got from them.

Let’s get a little more specific around that. Let’s say that you have a mortgage, you have a car loan or you have a business loan. What’s the downside of the traditional approach working with the banks? Working with different kinds of lenders or the car companies financing arm, GMAC or whatever, what’s the downside of that versus being your own bank?

Warren Buffett‘s father told him when he was seven years old that the most important interest is the interest you’re earning yourself, not the interest you’re paying off someone else. Most people want us to concentrate on getting rid of certain types of debt whether it’s a car loan debt or a mortgage. That isn’t always in your best interest. We can look at a $500,000 mortgage at 4% and we can easily figure out that we’re going to pay about $359,000 of interest on that mortgage over the 30-year period of time. We’ve got people out there scaring everybody saying, “You’ve got to pay your mortgage off early because you could save a ton of money in interest.” They have people scrimping in their lifestyle to come up with extra money to pay that mortgage off in fifteen years and you do save interest. The problem is nobody keeps that interest because when the fifteen years comes around, the house was paid off, they quit paying themselves. They don’t see that if they don’t keep paying themselves, they’re not going to save a dime. They’re still going to find some of the place to flow to and money that flows creates more money or more wealth in your life. You need to learn to control that otherwise it’s going to make money for someone else.

When you say paying themselves, you mean setting money aside that goes into a money machine into some investment strategy or something and not going into consumables or lifestyle and stuff.

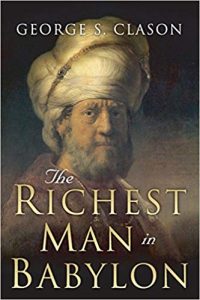

We like to use participating whole life insurance as a place to receive and keep that money. The Richest Man in Babylon is a book that I read when I was 25. It was given to me by an old doctor that was wealthy and smart. He said, “Tom, read this book, The Richest Man in Babylon. You’ll never have to worry about money.” I, in shame, said I didn’t understand that book until I was 45. He says that we’re supposed to keep 10% of the money we make and never spend it. I thought I was doing that for those twenty years. When we keep something like a pet, a plant or a relationship, it takes constant care. We have to take the pet to the vet. We have to groom it and we have to feed it. It’s more than just hoarding something aside like a lot of people think when they’re saving. If I put a bunch of money on a 401(k), that’s like hoarding it up until the day that I’m going to retire because I can’t touch it until then. If I keep the money someplace that’s growing but have access to it and it doesn’t inhibit the growth, I’m doing two things with the same dollar.

By setting the money aside and not doing anything with it, it stagnates. It doesn’t work for you. It’s not available for you to squander it, which is only half the equation. The other half is to put that money in motion and make it work for you.

That is a very good summary. I was born in 1960. $20 in 1960 would buy what $180 would buy now. If I haven’t done anything but stick $20 under my mattress, I’m in trouble.

That money has been shrinking.

We call that inflation and it’s due to several things, but primarily the things that are not in our control. We have to do something with our money to combat inflation that hides a cultic task.

I first heard about paying yourself first actually from David Bach and that was maybe a couple of years ago. I was at a mastermind called The Society and he came and spoke. Up until that point, I’m ashamed to say I did not pay myself first, not even close. Consequently, I had nothing to show in terms of any real savings or wealth that I had put aside. My lifestyle increased to match the income that I continued to make more and more of. Not a great strategy, basically a lack of strategy altogether until I heard that and it hit home. I need to not touch that money when it comes in. It needs to automatically go somewhere else as if I had never had it available to squander. There need to be some strategies for what that money does or where it goes and how to keep it in motion without me having to think about where to move each dollar that comes in that I’m not supposed to touch.

The 10%, 20%, 70% principle that The Richest Man In Babylon advocates has made so many millionaires who have read that book and applied that it’s unreal. 10% of what we make should be ours to keep and we should keep it very securely in a guaranteed place that it can’t shrink, that is going to keep up at least with inflation, if not better. We want to have access to it. We talk about something called guaranteed available manageable equity. Life insurance that’s designed properly can give you that equity to manage without inhibiting the growth on your principal.

10%, 20%, 70%, you’ve talked about the 10%. What’s the 20% and 70%?

Debt is not necessarily a dirty four-letter word unless we allow it to be. Share on XMost people have debt in our society and there can be good debt and there can be bad debt. We split that debt out. We put good debt out of the 20% but the 20% is to take care of bad debt or debt that will cripple you fast. We’re talking about personal lines of credit or maybe credit card debt where the compounding interest that you’re going to pay on that is going to kill you if you don’t do something with it. If we can keep money in a participating whole life insurance and get the growth on it, then we have the ability to leverage our death benefit and the insurance company will lend us their money at a lower interest rate than what we’re paying on consumer credit. That gives us an opportunity to repay our self and the insurance company the interest that we had been paying a third-party creditor.

You talked about bad debt and I think this is a super important concept for our audience to understand that not all debt is bad or something that needs to be paid off early, that there’s bad debt and there’s good debt. We want more good debt. We want less or none of the bad debt.

Debt is not necessarily a dirty four-letter word unless we allow it to be. If we allow debt to control our life, we’re in trouble. If we use debt to build assets in our life, then that is a good debt. We classify a mortgage as a good debt unless you’re purchasing a mortgage that’s way above your means. We classify automobile debt as a good debt because it’s very hard to get around in our society unless you live in downtown Manhattan without a vehicle. A lot of times people want to pay those good debts off before they take care of bad debt that’s crippling them.

What would be an example of bad debt? Is it like credit card debts that they haven’t gotten a habit of paying off every month?

We use credit cards extensively in our business because we like the cashback principle on that. We always pay those credit cards off at the end of the month because I never want to pay the 18% or 19% on the Gold American Express card that they’re going to charge me. Some people allow a revolving balance to occur and that 18%, if they can’t afford the minimum payment or even if they can, that interest compounds into their existing debt and it snowballs. Therefore, a small debt of $20,000 at 12% is going to end up costing you $52,000 by the time you pay it off if you pay the minimum payments.

Isn’t there some implication, positive or negative, in terms of your credit score like your FICO score by utilizing the credit card, by spending money paying for things on that credit card and then paying that off right away and not letting it sit with a balance? Maybe paying the minimum payments, it’s actually better to pay it off quicker in terms of your credit score.

It is very much so because everything that is outstanding on your credit card as what you owe goes against you. By paying it off every month, you’re showing yourself responsible and the credit card company sees that and they tend to actually raise your credit limit much faster.

That’s also a good thing in terms of your credit score because that lowers the percentage of available credit that’s being utilized currently. You mentioned that you build assets and use Other People’s Money, OPM. That includes money that you’ve put aside into your own whole life insurance policy. Let’s talk about the interest rate situation. You have some bad debt at 18%. You have some good debt at 6% or 7%. How does the interest rate factor into your strategy? It’s not in a vacuum. The prime and the markets go up and down and you need to be flexible with the times.

When you talk to the gurus about getting out of debt, there are two opinions. There’s the snowball debt reduction plan and there’s the avalanche reduction plan. One of them goes after the highest interest rate and tries to get rid of that debt first. The other one goes after the lowest monthly payment and they go after that debt first. We look at it when we’re helping people, consolidate and remove bad debt from their lives, we’re not looking at either one of those. It’s a combination of both because we’re trying to see what’s going to free up the most cashflow on a monthly basis when we’re tackling a debt. If we can free up cashflow on a monthly basis, then we’re going to accelerate the debt repayment faster and we’re also going to have enough money there to build an asset that otherwise, once you follow the snowball or avalanche plans, you’re at zero. You have no asset to show what you did. That becomes so discouraging for so many people. They turn around and go back and go right into debt again. It’s like someone that went on a fad diet that loses weight and they get there but they haven’t changed anything, they don’t see and they go right back and binge again.

They stopped drinking water or whatever as a way to lose weight. That’s not sustainable.

I’m glad you brought that word up because that’s one of the main things that we’re looking at is to build sustainable wealth. The plan that most people have is to accumulate a huge sum that hopefully will last them through their golden years when they don’t want to work as hard and as long as they are. There are two Nobel scientists. They have said that trying to accumulate your whole wad of money in a 401(k) or IRA is not the best way for us to plan for our golden years. It makes us want to assume way too much risk that we can’t sustain. The better way is to free up cashflow and learn how the flow of cash and the management of that cashflow will provide a sustainable living for us regardless of how long we live.

Let’s talk about how this all works and inside a life insurance policy. Hopefully, most of our audience have life insurance. It’s a must like having a roof over your head or having a bank account, you should have life insurance. Besides this capability of being your own bank through your life insurance policy, why does everyone need to have life insurance?

The way that we approach sustainable wealth is to protect what we might be able to create in our life first. That will automatically encourage us to save what we need to, which will give us the tool to manage debt like we need to, which will then give us the wisdom to know what to invest. The world tends to flip that upside down. They say, “You’re young, healthy and vibrant. You’ve got a lot of years ahead of you. Let’s go out here, take a lot of risks and invest in something.” Oftentimes, people go into debt doing that because their investments don’t pan out as they thought. If they do, then they say, “Let’s try to save some of this.” You mentioned already, Parkinson’s Law comes in and when you’re making more money, you tend to spend more money on a lifestyle that you didn’t have before. Finally, someone says, “Maybe I should try to protect some of this.” Oftentimes, it’s too late because someone has come along and sued you. You’ve been put in a position where your health has been compromised. We want to start with the protection part first. When we do that, then what we built is sustainable because of the guarantees of the insurance policies.

It’s a mindset shift. Could you define Parkinson’s Law because it has wide implications? If you are delegating to a colleague or a direct report or an assistant, Parkinson’s Law is very much in effect there. I’d love for our audience to know why.

What you owe goes against you. Share on XThe best example I can give is as a chiropractor, we were always trying to help more people. We would hand out a coupon to our existing patients and tell them to give it to a friend, a colleague or a family member that could benefit from the care that they were receiving in our office. If we didn’t put a date on that coupon, they never came to our office. If we would say, “By February 14th, 2019, you have to take advantage of this coupon offer, otherwise it’s void.” We would get a lot of smart people responding to that because Parkinson’s Law basically says that you’re going to take as much time as it’s going to take right up to the last minute. Think of when you file your federal income taxes. For most people, they’re going down and dropping it off in the box on midnight of the day of the filing because that’s the filing date. With finances, what Parkinson’s Law says is that, “If my income increases, all of a sudden my needs increase too or what I might perceive my needs are.” All that extra money get spent unless we have a system or a plan to set it aside and keep it.

You also mentioned this upside-down approach of investment strategists, financial planners telling you, “You’re young. You’ve got plenty of time. Let’s go higher risk.” That always bugged me. I didn’t gel with that. What’s behind that idea?

Let’s take a look at that. Let’s say, two young guys, 25 years of age, they decided that they’re going to start investing or saving for the future. One of them says, “I’m going to go with the guaranteed route. I’m going to sign contracts. I’m going to get a 5% return on my money and I’m going to save $1,000 a month doing that.” Another guy, same age says, “My advisor says I’m at an age where I can take a lot of risks, so I’m going to shoot for this 10% rate of return that my advisor says I can get. Because I’m getting such a high rate of return, I’m only going to save $500 a month.” For the second gentleman, he’s hopefully earning 10% and saving $500 a month. How long will it take him to catch the first gentleman who’s going with the guaranteed lower return of 5% but saving double?

He’ll never catch up.

Almost never because how risky is it to assume that you’re going to get 10% until the day that you retire? That’s probably not going to happen. Let’s say he actually does get 10%, it will still take him almost 25 years to catch up with the fellow number one. Do you think in that 25-year period of time that the market might not return 10% one year? The average is every eight to ten years. There’s a market correction where people lose 40% of their portfolio. If that happens, is it going to take longer for him to catch fellow number one? Absolutely. This is the idea about risk. You’re not young. We lose money. People that lost money in 2008, they got caught up. Everyone said in 2017 they didn’t get caught up. They only got to where they were in 2007. They lost ten years. That’s where we always say, “Wealth is not money. Wealth is time as well.”

Let’s talk about how you can be your own bank and not hit up Bank of America, US Bank or whoever to take out that mortgage and buy that home or whatever the asset is that you’re going to buy?

First of all, a lot of people think that just because I want to be my own banker or I want you to be your own banker that we’re going to get rid of banks. I don’t see that happening in our future. In fact, we have to function in a society with banks. We use our American Express card and our bank card and we use checking accounts. It’s important that we have those tools to interact in our society and our economy. However, I want to manage my money like bankers manage the money I deposit with them back when I did that on a regular basis. Going back to the mortgage that we talked about, we had $500,000 mortgage at 4% for 30 years. Most people would say, “Let’s get rid of that mortgage in fifteen years by paying the next for $1,311 a month.”

We raised our payment from $2,397 to $3,698. You will get rid of that mortgage in fifteen years and you won’t pay $193,680 in interest. Most people don’t continue to make that payment to themselves so they don’t ever see that $193,680. They stop at year fifteen and like we said, Parkinson’s takes over and the money’s gone. What we suggest is let’s take advantage of other people’s money. The bank’s going to give us their money at 4% for 30 years. Let’s use that and if we can do the extra $1,311, let’s put that $1,311 per month in a life insurance policy designed for high cash value instead of paying it to the bank. What will happen after the first month of $1,311 payment? Your death benefit will be enough to pay the house off of you’d died.

Let’s say you live a long time, what’s the benefit of having that cache of money there that you’ve put into your life insurance policy?

We pay that $1,311 for fifteen years every month into the life insurance policy. At fifteen years, we have enough equity cash value in that life insurance policy. If we wanted to, we could borrow it from the policy and pay off the house at that time. We could still get rid of our mortgage at year fifteen. However, we don’t recommend that because that’s violating what Warren Buffett’s father taught him is to leverage other people’s money as long as you can. We’re going to stop paying the life insurance policy at fifteen years and we’re going to let that policy continue to mature. We’re going to continue to pay the $2,387 on the mortgage and in another fifteen years at year 30, we have $596,631 in our life insurance policy that we can use. If we subtract that from what our costs were to fund the mortgage and the life insurance policy, it brings our mortgage down to only $498,000, which was less than the list price on it 30 years ago.

The asset value of that house is much higher because real estate tends to increase in value over time.

We’ve paid for the house because we paid $2,387 every month for 30 years. We were using someone else’s money, the mortgage banks. For the first fifteen years, instead of paying an additional $1,311 to get rid of that mortgage in fifteen years, we put that $1,311 toward life insurance for the first fifteen years. What that did is built up an asset in life insurance called cash value that we have access to. By the time we get to 30 years and pay the mortgage off, we have $596,000 almost $600,000 of cash value in our life insurance. To see what this has done overall, we have to take the true cost of what we’ve put into this and subtract that $600,000 because that $600,000 is still ours to use. We come up with all true cost of our mortgage this way was only $498,000 instead of $859,000 in the traditional mortgage or $665,000 in a fifteen-year mortgage.

Let’s say after you’ve accumulated a bunch of cash value in your insurance policies so that infinite bank that you have available for use, why not take out of that to buy the house and not get “mortgage” at all? Why still go to the bank and get money from them?

We could have done that at your fifteen. There was enough money in the policy to pay the house off the rest of the mortgage. The IRS is very picky about how we can deduct interest on our taxes. The mortgage interest payment is one of those payments, the interest that is still deductible to every United States citizen. If we borrow the money from the policy, we throw away that interest deduction. Why not continue to use the mortgage banks money? Does that make sense?

People don't make bad decisions if they have the right information. Share on XYes, it does. Let’s say that I take money out of my policy, out of my infinite bank to use it for my business, then I can still claim that interest expense and get a tax benefit from that.

We want to use this money in the policy for other things and paying our mortgage off because you’re losing a lot of money to interest. You don’t even realize until you sit down and analyze it. It’s a shame. Let’s say you own your own business and you know that if you had another X amount of dollars that you could make that business grow and your profits would increase. If we borrow money from your life insurance policy to fund a business expense and your business, then the interest that you pay to the insurance company is a tax deduction like your mortgage interest is. When you pay that interest to the insurance company, you make the insurance company more profitable and those profits are shared with you and all the other policyholders that own policies like yours.

Not every insurance company operates that way where you get to partake in the profits and the value creation that the company has been doing. Some insurance companies want to increase their value for the benefit of their shareholders.

It’s important that we always purchase these participating whole life insurance policies with a company that allows participation, not just for the shareholders. We want it to be with the mutual policyholders that own the company. Mutual companies by charter are not stock-held companies, they are owned by their policyholders.

Is that pretty common or is that rare to find that type of insurance company?

My last count was there are about twenty companies that are mutual companies. That doesn’t mean all twenty of them are companies that share equally with their policyholders because each company has a track record of how they have managed policy premiums and what profits they’ve made. We look for the companies that have done historically very well at paying their policyholders back in dividends every year consecutively for sometimes hundreds of years. The longer that they’ve done that, the more chances they’re going to continue to do that.

There are not very many insurance companies that provide this capability. Probably chances are you have an insurance policy with an insurance company that doesn’t support this be-your-own-bank capability.

We review so many policies that people send to us because they bought it from a friend, a family member, someone or their CPA that wasn’t in tune with what a life insurance policy can be used as an asset and a financial tool. They just bought it for the protection part. When we see that, we like to show them what it could look like. People don’t make bad decisions if they have the right information. I’ve found that people are very capable of making the right choices for themselves if they have the education to know what to do.

For protection purposes, you might have purchased a term life insurance where there’s no asset value to it and you’re just paying money and getting protection but only up until a certain age.

There are two types of term insurance. There’s the level term which gives you a level premium for maybe 10, 15, 20, 30 years sometimes. That could be important for a young family that doesn’t have a lot of savings or assets and they need to protect their income if some tragic accidents would happen and one of them would lose their life. Nobody’s going to be there to pay the educational bills of your children or pay the mortgage off, all those things that you would if you have a steady income. Term insurance becomes very important for particularly younger people that need to cover their liabilities. You always want to make that term insurance convertible to whole life. Let’s say that you buy term insurance as a young person to cover your future income if you’re not there to produce it and five years down the road you get disabled or you have a genetic disposition show up, where they say you can no longer be insured. The fact that you bought convertible term, you have the right to convert that term into a whole life and they can’t deny it. Whereas if you just bought straight term because it was cheaper and it’s not that much cheaper, maybe a few pennies on the thousands of dollars of coverage, it wouldn’t be able to have whole life insurance the rest of your life.

Many years ago when I had a young family, I purchased term life insurance. I don’t remember if it’s convertible or not. I should probably check that. I have infinite banking set up and I have lots of money in there and multiple policies, which is another thing we need to talk about too. You can’t increase the size of the policy once it’s in place. That very first policy that I got, term life policy, was with MetLife. That’s one of those companies that is not trying to enrich the pockets of the policyholders but the shareholders.

In fact, MetLife went through a solvency issue where they had to get rid of part of their insurance division because the Dodd Frank Act was classifying them as a bank rather than a life insurance company. If you had passed, that would have been a wonderful investment because, for the amount of premium you’d paid for that, your beneficiaries would have got a lot more money than what you’d ever paid for that policy. We have to understand that 99% or more of term insurance never pays a death benefit. Where do those premiums go to? They go to the insurance company that sold that. We want to be in a company that is profiting from that because that’s going to come back in our dividends as well as a whole life owner.

The dividends further accelerate the growth of that money machine that you’ve got inside your policy. That is compounding the interest even faster.

There are two parts to a whole life insurance policy that is a participating policy. There are the guaranteed values that the insurance company knows it can provide you and so that becomes a contract. When you look at your whole life contract, you’ll see guaranteed values. You can go down to any year in that contract and you can see exactly how much cash value and death benefit you’re going to have after paying X amount of premium. On the other side of that column and it’s called the tabular detail, then you’re going to see a non-guaranteed value. The non-guaranteed value is what the insurance company believes it can make above and beyond what it guaranteed is going to pay you, what’s going to have to pay in death benefits and expenses to operate the company.

There is no other place to start except where you're at. Share on XWhat they do in that column is they look historically, see what they’ve done and they make projections. When those projections are paid or when the dividend is paid, it becomes a guaranteed value for you. It replaces your guaranteed value. Unlike an investment, once a dividend is paid, it can’t be lost when the market goes south. Those dividends continue to build your death benefit, make it grow. The guarantee is that at the end of the contract, when the contract is mature, your death benefit, your cash value and what’s called paid-up insurance or equity are all going to equal each other.

When the insurance policy matures, that means that at some point if we live long enough, the insurance runs its course or it’s done.

They call that an endowed policy and different companies handle it in different ways. Most of us aren’t going to have to be concerned about that because most contracts written are based on 121-year life expectancy. If you make it to 121, congratulations, the insurance company just might write you a check for what your death benefit is because that policy would have been endowed. Other companies, they will actually add a little bit more term to that policy every year. You live past that to keep it alive, it depends on how your contract’s written.

There’s this concept that I’m very excited about is called Longevity Escape Velocity. I’ve heard this from Peter Diamandis from Singularity University and the XPrize Foundation. For every year that we continue to live, we’re actually adding an additional year to our lifespan because of the improvements in life-extending technologies.

That’s true for our generation but there is also research to show the generation behind us is not living as long simply because of their sedentary lifestyle, some of the dietary habits that they have picked up. It’s going to be interesting to see what happens. I believe that genetically, we’re programmed to live much longer than 120 years. The proof is in the pudding.

I read a statistic, I haven’t confirmed that it’s true or not but I believe it. If you are sedentary for eleven hours a day or more, you have a 50% or greater chance of dying within three years.

I would tend to believe with that. I know that some of the research coming out says that if you have a desk job or you have a sedentary job, just to get up and walk around for five, seven minutes every hour, is going to prolong your life by years. We have become very sedentary in our society and it’s not in our benefit.

You get this money machine working for you but you can accelerate the speed of this, not just by having those dividends get fed back into your money machine but also by doing what’s called a paid-up additions writer and putting in more money in the early years of your policy.

I like to make the analogy between real estate and life insurance because most people understand a little bit about real estate if not more than anything else in our society. When I got to buy a life insurance policy, the IRS is always interested in where you put your money. Typically, a policy is made up of base insurance, which over time the guarantee will mature and have the cash value, death benefit and paid-up insurance all equal the same. IRS has an exception to the code and says you can actually decrease your death benefit when you buy the policy and increase your paid-up insurance, which then allows you to have more cash value earlier on. It’s like going and putting an extra payment above and beyond what you would have to put on a down payment in a house. Your equity in that house is much higher from day one because of that. With life insurance, we can do that up to a certain point but we have to be careful not to pass the seven pay period that the IRS classifies as more money going into a policy in seven years’ time that would be greater than what it would take to pay that policy off completely.

Can you restate that a little differently? That’s a little complicated.

Let’s think about the house again. I could go in and write a check like I did for my second house and pay it off all at once. If I do that to a life insurance policy, I have violated the seven pay period and it no longer is just life insurance, it’s a modified endowment contract, which means that it can be taxed again. We want to avoid those taxes. We have to put money in it in the manner that the IRS will allow us to. The seven-pay period says, “The IRS can look at any seven years of the contract and if you’ve put more money into that policy in those seven years than what it would’ve taken to pay that policy off completely, then it is a modified endowment contract.” That can happen with you paying money out of your pocket or let’s say you’re going to borrow from your policy and pay off an 18% credit card. You’re going to put the 18% back into the policy but the policy, its loan maybe is only 4%. There’s another 14% that you’re trying to get into that policy that the insurance company and the IRS don’t see as an interest. They see it as an additional premium payment.

We have to manage this money. That’s called a modified endowment contract. A modified endowment contract can occur because you pay too much out of your pocket to pay the premium. It can happen when we borrow from the policy at say 4% and pay off a debt at 18% and then try to get that whole 18% back into the policy along with the principal. There’s 14% that will not fit into that policy. We have to become wise money managers and this is where the term becoming your own banker comes in. What do we do with that extra 14%? It may be that it’s coming in consistently enough to buy another policy with or we just have to manage that money and make it grow so that we do have a consistent and affordable return on that that’s going to buy a new policy.

We could continue to add more policies as we make more and more money. The more successful, that’s great. There’s a point where the insurance company says, “I think you’ve got plenty of insurance on yourself. We’re done here.” What do you do?

I have not reached that point in my life even though I have eight policies on myself and eight policies on my wife. We’re spending about $500,000 a year on premiums but it does happen. It happened with all my children because we cannot buy any more life insurance on our children because they’re at their maximum insurable level. As they’ve become adults and start creating income themselves, they’re able to buy policies on themselves. I personally can’t buy them on them anymore because they’re at their max. When we reach our max or maybe even before we reach our max, it’s important for us to look at other insurable interests in our life. If you’re an employer, you have an insurable interest in your key employees. If you’re in business together, you have an insurable interest in your partners or your members in your LLC. You have to make sure that you file those documents right and fill out the proper IRS forms or the proceeds from those policies will become taxable. Just follow the rules and you can insure key people in your business, you can insure partners in your business or fellow members in your LLC. You just have to follow the rules and make sure that you’re not violating anything the IRS has laid down.

I haven’t done that with any of my key staff. Do you get people saying, “I don’t want you to have an insurance policy on me, I don’t want you to essentially incentivize for me to have an unfortunate accident?”

That can happen sometimes. It depends on how you approached the employee. One of my associates when I was still a doctor, I bought a life insurance policy on him. I encouraged him to buy a life insurance policy on me as well because we both had an insurable interest in each other. If he lost me, he lost his job. If I lost him, I lost income. That’s the key factor there on ensuring an employee or an employer. It can be a mutual benefit to both. What happened with that case is when I got out of the field of chiropractic, I own that policy on him because I’m the owner and he would still own the policy on me. We’ve had that relationship at the time it was purchased. It depends on how you approach it. Some employers use key employee policies as a way to add bonuses to their employees or even retirement benefit plans. For example, Rex Tillerson, our former Secretary of State. Exxon has purchased life insurance on his life. He’s got $53 million sitting in his life insurance for his retirement that won’t be taxed. That’s cool. The CEO of Comcast has $232 million. It depends on how we explain the benefits and educate people.

It’s not taxed if Rex takes the money out as a loan. It would be taxed if you took it out as a dividend, right?

It would. The owner of a policy, which in this case is owned by Exxon on Rex Tillerson. When Rex goes to access that money as a retirement benefit plan, he will pay the taxes on it as he takes it out because he didn’t pay the premiums personally. If Exxon had bonused Rex money to buy that policy personally and bonused him enough to even pay for the extra taxes he would have had to pay on that bonus, then Rex would have been able to pull the money out up to the cost basis without ever paying taxes on it.

The money that I have put into my own policies, my infinite banking is available without tax because I would take it out as a loan, not as a dividend. I wouldn’t decrease the cash value of my policies. I would take a loan against that cash value and then my death benefit would pay back the loans on my death.

Our objective is to help people understand the value of participating whole life insurance earlier in life than later. The dividends can be used to pay the interest on any policy loans that you take during your retirement years. They’ll have a chance to get large enough to offset that. The nice thing about it though is we’re not locked into any one given way, whereas if we invest in a 401(k) or an IRA, then when we turn 70 and a half, we are required to take minimum distributions. Those minimal distributions are based on how many more years the actuarial tables say you’re going to live. Those minimal distributions can require you to pay the excess of taxes over and above, beyond what you ever differed in your working career in a very short period of time of retirement. That’s the benefit of building money up in a participating in life insurance. We can avoid those required minimum distributions. We can borrow from it if we need to or we can withdraw cost basis.

Let’s say that the percentage rate that you get paid by putting money into your policy is 4% by the insurance company and you take money out and use it for your business, you use it to buy a house or whatever and you have to pay 4.5%. Somebody who’s looking at this from the outside and no understanding fully how infinite banking works, they might think, “Doesn’t it make sense for me to just let the money ride and get paid 4% rather than take the money out and have to pay back more than the 4%? I’m actually losing money and instead of making money on the money that is in my policy that I end up using.”

There are two things you need to understand about that question. Let’s approach it first with the fact that in life benefits, we never encourage someone to borrow money from a policy unless they know they can make more money than what the interests they’re going to pay the insurance company. It doesn’t make sense for me to borrow money at 4% from the insurance company to pay off a debt that’s only 2% on my automobile. It will never pan out. The math won’t own that. However, the second part of that question is you are not losing the growth in the policy while you have that policy loan out. That is critical to understand. How do we explain that? Let’s take $10,000. Let’s say that you borrow that $10,000 from your local bank at 4% and you have to pay it back over five years. Your monthly payment’s going to be about $187 a month. You’ll end up paying $11,231. I’ve rounded that off. There are some cents on there, so don’t hold me too tight. What if we just turn around and put that $10,000 we borrowed right back into the bank we borrowed it from and buy a 3% paying CD for five years? Over the course of time, that 3% will compound on that $10,000 and by the end of five years, we’ll have $11,561. That proves that we can make money earning less interest than what we’re paying to use it.

When you take money out of your policy, it’s as if all of the money is still there getting the 4% but then you’re charged a fee for use of that money that you pull out, that’s at 4.5%. They make a little bit of money off of you, the insurance company does in order for you to have that liquidity available. When you pay it back, you want to pay it back with even greater interests. Let’s say that you loan money to a family member so that they can buy a house and let’s say you charge 6%. The cost of the money for you at 4.5%, you’re making a spread thereof an additional 1.5% and then you feed that back into your money machine to further accelerate the growth.

What we have to understand is that when we first start out in a policy, whatever interest rates, the internal rate of return is going to be over the lifetime of that policy. We don’t actually see the dollars in our policy to begin with because we’re still overcoming the cost of the insurance. That’s why we always advocate, don’t borrow the money from the policy unless you can make money on what you’re going to be using that principle on and pay the interest. At the first, if we just borrowed the money and pay it back at the same interest rate or even a little bit lower, we’re not going to have as much capital years. The whole principle of becoming your own banker or what we call the perpetual wealth code is the free cashflow that it’s developing for us.

I think Jeff Bezos has probably shown us the value of free cashflow better than anybody else. If we’ve read his share notes over the years, he talks about that profit margins are not one of the things that Amazon is trying to optimize. They’re trying to optimize free cashflow. Free cashflow is money that you can use over and over again without paying taxes on it. If I can take a policy loan and use it to pay a debt off and as that debt comes back to me as the money manager, I can use that money to buy a piece of equipment for my business and that makes me more money. I can use the money my business is paying me back to take a vacation and I pay my vacation back as if I paid a credit card back, then I’ve used that money three times. Every one of them is either saving me money or forcing me to pay myself what I would have paid someone else.

That’s the free cashflow that allows me to do that. That’s why Jeff Bezos is able to use shareholder money to do that with. He also uses the fact that you and I sell books on Amazon and he doesn’t pay us for three months after he sold our books. He gets to use that money. He has money. When Whole Foods is an opportunity, he can plop $13.7 billion down and walk away with another asset. If we can understand that, it’s not so much that the policy is a great money maker or gives us that high of internal rate of return. It’s that that doesn’t penalize us and stop the growth on our money, while we get to use it for multiple things outside the policy. That’s a huge factor.

It’s like this policy or this bank we have available to us of our own money that adds to whatever other investment strategies that we’re doing if we are investing in real estate, if we are investing in the stock market, we’re investing in cryptocurrencies, whatever it is. By doing that well and on top of that using the money from our policies as the bank to get money from instead of borrowing from Bank of America that further accelerates the growth of our money.

We have clients all over the United States and around the world that are using their life insurance cash values as free cashflow, like Jeff Bezos does to purchase assets, whether it’s real estate, whether they’re trading options, whether they’re doing micro-loans to people or whether they’re investing into their business or a combination of all of those things. The more you can use that money and create either a portfolio, income or a passive income, the better off that you’re going to be. Ultimately, we want to get out of the earned income category before we reach our golden years.

I’m sure everybody’s heads are exploding with all this information. How do they take action? How do they work with you to get all of this setup and not make any stupid mistakes with getting the wrong type of policy or going with the wrong type of insurance company?

I appreciate that because we do look at so many people who have bought the wrong product because they’ve heard a snippet here or a snippet there. They think they know and they go to their family member that sells life insurance, their person that goes to their church or belongs to their club. Most people don’t understand how to set these policies up. We encourage you to call our office at 702-660-7000. We offer a strategy session with you. That’s complementary. We talk to you because each one of these things has to be designed around your goals, your purposes, your income and where you are in life. We can’t start any place else except where you’re at. The other thing you can do is you can always go to our website at Life-Benefits.com. We have all kinds of videos that you can educate yourself with. You’ll have the opportunity to download my free book, Prescription for Wealth that will walk you through how I started my own policies and also gives stories of several clients that started several years ago.

Thank you so much, Tom. To our audience, take some action.

Links and Resources

- Life Benefits

- Facebook – Life Benefits

- Youtube – Life Benefits

- Prescription for Wealth

- Winning Your Financial Game

- Retirement Curveball

- The Richest Man in Babylon

- Ray Poteet – previous episode

- Bob Allen – previous episode

- MetLife

- Infinite Banking

- Warren Buffett

- David Bach

- Parkinson’s Law

- Bank of America