In this Episode

- [00:39]Stephan introduces Steve Baker, a top-rated speaker, and coach on the subjects of open-book management, strategy and execution, leadership, and employee engagement.

- [05:45]Steve tells the story of how Jack Stack was able to save more than 100 jobs in Springfield, Missouri.

- [11:08]How do you define your company’s critical number?

- [16:56]Why communicating with your employees about creative ideas can help the whole company go through this pandemic.

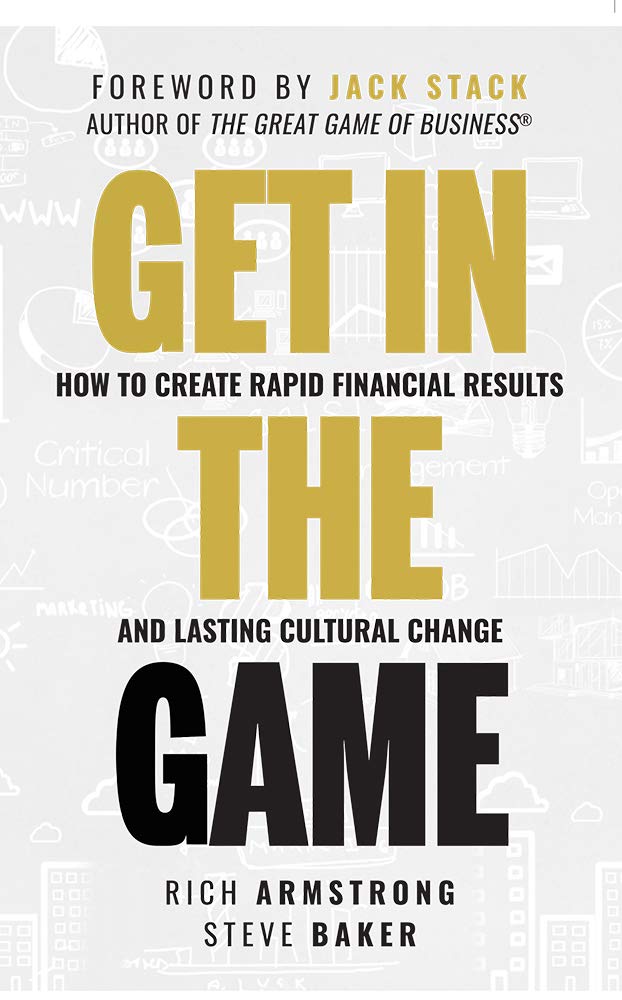

- [22:59]Steve explains how they have structured his book Get In The Game as the “how-to” of Jack Stack’s principles in his book, The Great Game of Business.

- [29:38]Steve shares how they execute a miniature version of the Great Game of Business per department and how much it increased in profitability for 2019.

- [39:28]Steve expresses how their company’s Employee Stock Ownership Plan (ESOP) transforms capitalism by giving people a stake in the outcome.

- [48:11]Steve highlights the advantages of having an ownership mindset organization.

- [54:28]Stephan shares one of his clients’ company, myfirstsale.com, a framework where kids can make money by selling things.

- [1:01:41]Visit their website greatgame.com or directly go to greatgame.com/steve to get a sample of Steve Baker’s book, Get in the Game, and to check out more resources.

Steve, it’s great to have you on the show. Thanks for joining us.

Stephan. Thank you. It’s an honor to be here.

First of all, let’s define for our listeners who are not familiar with that term, open-book management, what is it and why should they care about it?

Well, that’s a great question, because if everyone understood it, I think we’d be in a better place right now. But open-book management is often thought of as the idea of cracking open the financials and getting people engaged around the numbers. The interesting thing is there are a lot of people who are “transparent” with their employees, and they get up at the podium once a quarter and say, “Well, our results from last quarter sucks so get back to work,” all historical information. The way we look at open-book management is, what if we could teach people on the frontline of the business who actually create the numbers in the business to actually take ownership of the numbers that they produce, forecast them every week, and help the company become better? So they actually think, act, and feel more like the owners do than a frontline worker.

Right. So acting like an owner, as in they’re operating off of the same score sheet that the executives and the owner is operating off of.

Yeah. In the pre-show time that we had together, sort of in the green room so to speak, Stephan, we were talking about my background and everything. In my previous life, I’m just telling you that it was not uncommon to be out there thinking you were winning in business. Making decisions every single day on behalf of the company in sales, branding, marketing, and working with the biggest retailers in the world. And then years later, finding out that the best deal you ever made, the company lost money on. And it only came down to we got to see down the margin, nothing else. What we were doing was selling stuff, typically stuff nobody needed and we had no idea that we were really supposed to be building a great company. And so the stuff I was worried about was, and almost anyone listening has probably felt this at one point in your life, can I make my mortgage payment or my rent? Can I pay for the car? What about the tuition and braces and medical bills, right? All that stuff and will I have a job tomorrow?

That’s a big deal, especially right now. Well, what does an owner worry about? They worry about cash, competition, material cost, labor cost, and all the stuff about building a great company. Well, those are two terribly different things. And all The Great Game of Business is about open-book management is saying, “Hey, if you want all this stuff, job security, raises, bonuses, and all that good stuff, that comes from a growing sustainable and profitable business. Why don’t we teach them what creates a great company and they’ll get everything they want?” So that’s where the idea comes from. Are we thinking like employees? “Take care of me, you owe me.” Are we thinking like owners, like entrepreneurs? “Let’s take this risk, let’s go after it, and it absolutely transformed my life.” The understanding of, “Oh, now I know why I’m working so hard. I didn’t have any visibility before.” So we’re just asking people to treat their boys like adults.

It creates alignments, shared common goals, outcomes, and the common kind of enemy or villain, it just gets everybody on the same page.

Yeah, that’s where the whole game really centers around is this idea of a critical number. This one thing that we can all focus upon and it may be a weakness that we need to drive out of the business. So your listeners might not know Jack Stack like you do, but Jack Stack and 12 other managers bought a dying division of International Harvester way back in 1983. Because they were the best in the world at what they did, remanufacturing engines and engine components, no one cared except them, of course. Best in the world but international was going out of business laying off 1000 people a week back then because it was another black swan, another terrible economy and they weren’t competing globally. Just an awful story.

So Jack and these managers said we got to save these 119 jobs here in Springfield, Missouri. They went out and got the financing that took them to 54 different banks to take on an 89:1 debt to equity loan because they needed 9 million. They laid $100,000 down, but they did get it. And along that path a year and a half of struggling with lenders to find somebody who was desperate enough to take it, Jack learned that he had the wrong scorecard. All these years of working in manufacturing, great warranty rate, best safety record in the country, on-time delivery, customer service, banks didn’t care. They wanted to know when you’re going to pay the money back. So he learned that universal language and he figured out everyone on the line should know the language as well because they couldn’t make a $10,000 mistake. And that’s a big idea. The critical number then was, make the bank loan payment because if they didn’t do that, their quality on-time delivery warranty, none of that mattered, the bank would come in and take it away. Jack knew every single person on the line knew what happened if you didn’t make your mortgage payment. If you didn’t make your car payment, the bank could take it back, he just applied it to business.

We can demystify business and make it approachable, where we actually make a difference and change lives. Share on XAnd the first scorecard was $8.9 million on this side of the time clock, a hundred thousand on this side. He said let’s move $1 over here to the hundred thousand dollar side, the idea of a balance sheet, just very simplified. And what he realized was his secret language of business wasn’t new, these financial statements that we still use today were created by Luca Pacioli in Venice, in 1494, haven’t changed in 500 years. So, for me as a guy who’s learned this late in life, it’s been absolutely mind-blowing because I’m trying to teach my kids as fast as I can I go. “Wait a minute, we’re looking at the wrong scorecards, guys. Let’s figure out how we can teach you how to manage money. It will absolutely change how you live your life.”

Amazing. And yeah, I remember the story in the book, when I read it the first time in the 90s and just imagining that big lit-up board with the number that everybody on the line could see, that everybody from the night shift, the janitor, would be able to know “Did we hit our number yet? Are we going to be able to pay the bank?”

Yeah, for sure. And the funny thing is, is that if Jack would have just come out and put a big blazing number out there and said, “We gotta get that number, you’re out of a job,” that’s one conversation you could have. Or you could say, “Here’s the enemy,” like you said, you pointed out, you could have a common enemy. It was like, “This is the weakness in our business. To have a great company we can’t have debt like this. Let’s go after it,” and sure enough, people will rally to something like that, a common goal where we all have something. But the problem is what Jack ran into and anyone will run into is when you have great technicians, and I don’t mean machinists and mechanics and engineers necessarily, but it could be doctors and it could be artists, and it could be anyone who’s in business, and you say “Hey, great technician. I want to teach you about the financials, yahoo!” They’re gonna go, “I’m an artist, I’m a healer. I’m a machinist, let the bean counters do that stuff.” And Jack had to use this analogy of a game because he knew everybody was competitive, everybody likes to win.

The Great Game of Business was simply a way for him to teach people the numbers without it being intimidating.

So The Great Game of Business was simply a way for him to teach people the numbers without it being intimidating. He said, “Why does it have to be an elite sport? Why can’t we demystify business and make it approachable, where we can actually make a difference and change some lives?” And what he sees is the American dream, and I would agree with it, everybody has a shot, we all have a shot. What are we going to do with it?

It reminds me of the concept in software development called “gamification”, are you familiar with that term?

Oh yeah. I mean, we hear that a lot, especially when we’re out on the road speaking because people would go “Yeah, we can do this.” But you have to make them believe that they could actually take the gamification which you can use, of course, to not only produce things but also to engage the end-user, to make it like, “Here are some badges,” and “Hey, here’s some recognition,” all the same elements of a game. There’s a common goal, there’s a scorecard so you can clearly see if you’re winning or losing, there are rules, and there’s a reward for winning. So all those elements can be taught for software development, or video games or making engines or anything else. And that’s the thing to be honest with you, when I first came on board at SRC, at The Great Game of Business, Jack was in the middle of another acquisition, which is, of course, what we’ve done we spun-off 66 companies since 1983. And it was interesting to me to see how my gifts that I was bringing to the company – marketing, branding, identity, all these great things – they’re like, “Yeah, that’s fine but what we really need you to do is think like a business person.” I was hurt like, “What about me?” and the thing is they were absolutely right. We got to get over ourselves and say that makes a great company, and then teach everybody that and the fallacy about open-book management is that someone will care. And I think I’m the poster child for that, because I really didn’t understand, and so just throwing the financials open, doesn’t do anything. Transparency without education is worthless.

Gotcha. Okay, so how do you find that critical number?

Great question. So sometimes they scream at you, like if you have 89:1 debt to equity. That number is telling you financially you’re brain dead, so that’s a critical number but a lot of times the critical number has to be kind of sussed out, kind of teased out if you will. So we actually have a process and it’s in the new book, Get In The Game, available wherever fine books are sold. But we actually describe the process because what you do is you take all of the different inputs that we really have in business. So you’ve got financial input of trends in our business and in our marketplace. And so then you got the market itself, you’ve got operations, and you got people. And when we begin a process of critical numbers, we actually ask everyone in an organization, where they get 10 or 10,000 people, to do a survey and ask them what they think our big issues are. And if you’ve ever done a SWOT( analysis, strengths, weaknesses, opportunities, threats), a lot of those same questions will come up because we’re asking them what do they think. You’d be amazed at what mostly, what we would call frontline people, anyone dealing with a customer, or working with a product on a service. So I’m talking about somebody writing code, or somebody making an engine or somebody that’s on the front line in a health clinic right now taking someone’s temperature, if they understand that their actions and decisions really affect the financial performance and health of the business or organization for profit or not for profit.

We all use the same financial statements, that’s the magic. It is, “What do you think it is?” And somebody will say, “Man, it just seems like we ought to have more clinics or we should have this or that.” You gather all that information. And when you consolidate it, what happens is that critical number is pushed to the top, because believe it or not, the one thing you want to do is drive a weakness out or pursue an opportunity. So right now, somebody might be saying our biggest weakness is, “We don’t have enough cash,” you hear this a lot right now. Or the other one might be, “We need to go acquire another business so that we can grow in the next five years,” could be something like that. I will tell you lately, in the last six months, you bet you’ve had people going from growth to can I get cash? So it changes too, right? So we say just pick one for a year, not for all time. Pick one for a year and go after it, people will learn it. So we have weekly huddles around the forecasting model that we do so that we can say, “Are we going after debt to equity?” As an example, in the first critical number 83, don’t you think after 52 weekly lessons on moving that number from 89 to one to something else to the positive? Do you think everyone learned debt to equity as a ratio? Absolutely, people are smarter than we give them credit for.

SEO is more important now than ever before, because people are searching more than ever before.

Yeah, that’s great. And so we pick one for a year. A lot of people have gone through these tough times right now with not enough cash, clients or customers are just canceling or reneging on deals or just not having the ability to pay. I’ve had some clients who have been severely affected by the downturn and we need to adjust. So let’s use me as an example. I have a consultancy, helping clients with their SEO, with search engine optimization getting higher rankings in Google, so several big clients had to cut their spends significantly with me and, of course, there’s an impact for me in that. So they’re trying to reduce cost because it’s like one of them lost 50% of their revenue in this downturn. I can’t imagine them trying to deal with this. My understanding is that they’re not even able to cover their payroll with that new revenue number.

Wow, isn’t that tragic? And we haven’t even begun to hear all those stories yet. But there are so many people who are running it so tight, and I don’t mean tight like in a good way but so close to the margins that if they can’t cover payroll, that’s a big issue because we believe it’s really about jobs and people. In fact, six months ago, everybody was complaining they couldn’t find people, unemployment here was 1.7%, what a different story we have today. So let me go after it this way, so I’m in consulting and training too. Even though we cut out of our budget, it was training and consulting because we understand it is an easy one to cut. A lot of people cut marketing, now you’re going to advise them, well, don’t cut marketing, now’s the time to make sure that your brand is out there. I’m sure you’re saying to every client, SEO is more important now than ever before, because people are searching more than ever before, I would assume.

And so you got two ways to cut at it. The offensive way is to go and get more revenue, get a creative start. I’m just going to make something up, Stephan. What if you said, “I’m going to go after not for profits,” I don’t think that’s the right play for you but let’s just flow with that and say a whole new segment we haven’t had time to mess with before we’ll go after them. So that’s offensive, we’re going after new revenue. The other one is to cut costs. So for a lot of your listeners, people are going “Well, I’m gonna have to lay people off.” Well, are you? The first thing is, we’re talking to folks all over the nation. What I would say is, in Missouri, we have a shared work program, so in other words, to keep people from going on unemployment, you can actually negotiate with the state and say, “I’ll pay him for four days, you pay him for one.” In other words, we’re saving jobs keeping people at work.

Transparency without education is useless. Share on XThe thing is when this all started, imagine we have 2000 people in 10 different companies in SRC, most of them are essential, great game is non-essential. So we took voluntary 40% cuts and we went out there and looked for all these other programs. So you got to look at your business in a whole new way and say, “Why do you have to lay awake with it all at night?” For those of you with employees, ask them, if you don’t talk to them they’re getting all their information from CNN and the internet and everywhere, bad information. So what if you were the one source of information that said “First things first, let’s protect people, let’s take the fear out of the workplace, you’re going to have a job,” or maybe “We do have to cut hours or cut salary.” We have stories, Stephan, from across the country where people will volunteer for furloughs and other things. Once they understand what the big picture is, I bet you have some clients that are like, “Man, if things turn in another 90 days, we’ll be back online and all of a sudden, you won’t have the people you need,” right?

Right.

I’m guessing. And this is all over the place because people are saying the unemployment claims are at all-time record highs, and I’m going this is so crazy because of the fact we couldn’t find people a few months ago. So I don’t know if I’m helping you but do you see where I’m headed with this? Offensively, it’s go get more revenue and new creative ways and ask your people, “What could we do differently?” And secondly, is to cut back on costs defensively and say, “Well, what is not necessary?” I just got off a call earlier today that I thought was awesome, a client was telling us, it’s about the fact they’re a second-tier or third-tier manufacturer for the OEMs like GM, Ford, Chrysler, Toyota, people like that, and of course, with car sales down what happens to your supply chain? And this guy was saying, “It’s not a problem. We have plenty of cash. We’ve been planning on some kind of a downturn, we didn’t know it was going to be a pandemic, but we’re gonna be okay. As long as this and this happens.” And his team was like, “Well, are you going to that conference?” He says, “No, the conference has gone virtual,” “Well, are you going to it anyway?” And this is some conference that’s industry-specific, and the guy says, “Well, yeah, I was still going to go.” And they go, “We’ll get your money back. Because you know what we’re doing is the snacks that we get in here, we’re cutting out the snacks, we’ll bring our own snacks while we’re still working.” The idea was they were going “You give up something, we’ll give up something.” And I just love the story, it has nothing to do with the actual dollars, it’s the spirit these people understood what things were worth.

That’s great. So if we were to focus on, I’m just being hypothetical here, let’s say this revenue generation, and maybe that critical number for my team is billable hours that we need in order to make a profit. And this is how many billable hours we have for the month so far, and this is how many we need to hit profitability. So do you think that’s a good example of a critical number?

I think it’s a great example. And the reason is, because who owns that number? It’s not you. You can say, “This is what it takes to keep the business going, and let me explain to you why it’s important.” But what’s fascinating is if they own the number, they’re much more likely to hit it than if you impose it upon them. So I might approach the story like this, I’d say, “Guys, here’s the reality, this business requires this many billable hours just to be zero, just to make payroll, keep the lights on whatever it is. Now if we go above that, that’s a gain, I’m not saying profit share but perhaps a gain share if we can make sure the company is stable, maybe it’s above breakeven.” And we say “These are the investments that we need to make,” maybe share the gain after that, right? So the company’s okay, maybe we can share that.

It’s about involving as many people as possible in creating the goal because they’re the ones that are responsible for executing.

But just in the first conversation, say how many billable hours do you think is possible right now and they’re gonna go “Oh, it’s this many,” your optimus will be way up here, and your pessimist will be like, now there’s no way we better be conservative, and somewhere in the middle people knew what’s realistic. So reasonable, achievable stretch, that’s what I asked people, no matter what the metric. I don’t care if you’re writing code, or if it’s consulting hours, or if you’re turning a wrench, you’re the expert here, what do you think is possible? And then you just shut up, it’s so hard because you gotta let them think about it. They go “Well, I don’t know, what do you think?” You go “Well, you’re the one doing it, what’s possible?” and somebody will go “Eight hours a day,” “Okay, is that possible?” Then you go, “Well, where could you find this out?” I love it when people that are doing the work at any level, and this could be management as well as frontline folks. And you go, I don’t know what the number of billable hours should be, for a company of our site, go look at the associations you belong to, go look at any sort of industry information, go to your bank and ask for an outrageous sum of money, they’ll run your NAICS code and tell you how much you suck. Because they’re gonna see how much of a credit risk you are. And they’ll show you the high performers, the low performers and in those metrics, they’ll tell you what your margin should be and what your billable hour should be, and different things because there are people out there who are also borrowing money. I know it sounds a little crazy, but it’s about high involvement, it’s about involving as many people as possible in creating the goal because they’re the ones that are responsible for executing.

So if they feel like we’re part owners in forming that critical number, then they’re going to be more inclined to try and make that number work.

I think so. To be honest, in my past life, being given a number, I’m a people pleaser, so I’m like, “Oh, okay.” I remember a guy coming to me and saying, “Steve, we need $6 million in sales, this is a small family-owned manufacturing company, this is what we need.” And he went back to my office, and I dutifully took out a calculator and created the numbers I needed, put them in a spreadsheet, I basically divided the 6 million by 12, back end loaded the fourth quarter. Sure, this is what we’re doing, “How are we going to do it?” was a different question they never asked. And that’s the question you should ask first, how are we going to get there? What does that look like and what do we all need to be doing? Maybe we need some additional help, maybe we need to cut back a little bit. I mean, there are going to be tough conversations that you have to have, as with anything that’s worth doing, and it’s going to really test your culture. I mean, you will lose people who say “I don’t want to do that, all I want to do is turn that wrench or write that code or take that temperature,” and that’s okay, they can work for my competitor.

Got it. And now, The Great Game of Business was really the book that explained the importance of having open-book management, having everybody on the same page, and having that critical number and so forth but it didn’t explain all the how. And that’s where your new book, Get In The Game, explains all that how. What structures to put into place and how to get those into play, how to course-correct as needed, for example, you mentioned weekly huddles, is that something that’s in the book?

Yeah, so Jack talked about what he called the “great huddle” back in the 1992 book, The Great Game of Business. And he talked about what they did and even showed an example of a scoreboard but not much about the cookbook side, how do you actually build that, and what is the cadence of that accountability look like. So what we did in Get In The Game was to actually take each of the components, the principles and practices if you will, and put them into 10 straightforward steps. They are simple, I will not tell you that it’s easy, because it does take a lot of leadership and a lot of courage and a lot of gotta wanna as Jack says, if you really have to want this. But when you do it, it’s so amazing, it just is the most freeing style of leadership I’ve ever been around. So in the new book, we walk through the huddle and how to structure it, here’s a formula to make it work, here’s a typical scoreboard, and also all these tools in each of the 10-step are free, and they are available for anyone. So if there’s a tool or a template mentioned, it’s all for free and what we’re really trying to do is spread the word, really open up the number of people that are exposed to this. And now, more than ever, I think it’s important.

So you said there are 10 steps to this methodology or system? Can you go through what those 10 steps are?

Man, this is the best podcast ever. You say, “Steve, tell me what you did,” this is great so you can tell me if my baby’s ugly, now when we’re done. So first of all, the idea of The Great Game of Business, this operating system is almost 40 years old, we’re talking way back in 83. Jack didn’t write about it for almost 10 years until someone was finally just beating him saying, “We want you to write a book.” He says, “No, I’m too busy,” and they say, “We’ll give you $55,000 advance.” He says, “When do you want the book?” He went and bought a camshaft grinder with it to keep the business growing and all that. So long story short, we have to recognize that there’s a lot of really smart people that have helped build this over the years, Rich and I just took it and put it into a format.

Reflect on yourself. Are you an autocrat? Are you a people person? What is your style?

So the 10 steps go like this, it is to begin with the right leadership. First of all, you got to reflect on yourself, are you an autocrat? Are you a people person? What is your style? And it’s not to judge, it’s to say that we believe you should have certain characteristics. You’re going to be transparent, obviously, you’re going to have to have things like vulnerability and humility, and admit you don’t have all the answers. But you’ve got a whole bunch of people that you can harness the wisdom of the crowd. Begin with the right leadership, look at ourselves, and also explain how to create what we call a design team. So you’re not doing it alone, you can actually rank them, have them ranked themselves. You can also rank them and then compare them to see where the gaps are. The second one is share the why before the how, and this is one of my favorite parts of all because nobody ever told me why we were doing any of this stuff we were doing till I got to SRC, and then it was not like we make engines or we sell books or we do this. They said, “We want to help people create great companies because that’s what creates everything.” The economy in the US is all small to midsize businesses, this is where the jobs are created, this is where families are fed and communities are taken care of. Sorry if I get emotional, just tell me and I’ll get a tissue and we’ll move on.

It’s really powerful stuff. So the why before the how is where most people think about purpose, the long term vision, and the noble cause. Why do we do what we do? Because if people can understand why they’re doing it, they’re much more likely to go for it. The third one is where open-book begins, so open the books and teach the numbers. This is where we’re talking about literally teaching people for the first time, how hard it is to make money. And we got some great exercises in there and some great videos as well about how different people have opened the books to their folks, how they’ve said, here’s what $1 does in business, look how little we have left. And as an example, I love this one, it is the average company that makes six and a half cents on the dollar. That’s the average in the United States, the average employee thinks you make 36 cents on the dollar. That’s a huge difference and I’m telling you it’s so true. That’s one of the first things we do as coaches, we’ll go in and say, “Hey, how much do you think we make at this restaurant or this clinic or this organization?” They’ll be like, “50 cents, 75 cents,” and you go “We make three cents.” “What?” And then we actually build an income statement with him, it’s just very simple, nothing fancy. “But where does the money come in? Where does it go out?”

A good leader is someone who’s transparent and humble. Someone who’s not ashamed to say, 'I don’t have all the answers.' Share on XThis is what Luca Pacioli missed 500 years ago, one column for someone’s name by every line item who owns the number. So if you talk about billable hours, I’m gonna break that down and say, “Alright guys, I’m gonna own this maybe I own revenue or maybe I own admin or whatever but whoever owns billable hours, I want them on that scoreboard every week.” So we’ve got to begin with the right leadership, we have to begin with the why before the how, open the books and teach the numbers. And then we go, what’s the critical number? So we actually walk through that process and say, “What’s the one thing that matters most, the one thing we really need to go after this year and nothing else matters?” Then step five is to act on the right drivers, what drives the critical number. So this is where we learned about the line of sight, the people doing the work, and this is at any level, whether it’s management or frontline, everybody needs to have a clear line of sight to that critical number.

So if it was debt to equity, and I’m talking about the early days of SRC. Some guy or gal who is grinding a crankshaft needs to understand that the amount of oil, they use the abrasives, they use the number of pieces that can’t be remanufactured and have to be replaced with new, these are things they may not know before. They were just hands. Now, they are head, heart, and hands. It’s, “You’re the business person, how would you run this camshaft business?” And it’s powerful. If somebody is doing billable hours, what I like to think about is if we weren’t taken care of, what would we do differently? Right? “If this was your business, if you were doing this, how would you make more billable hours possible?” And it’s amazing how that unlocks creativity. So there will be that critical number, the drivers, and then mini-games. So this is the silliest sounding thing in the world, mini-games. So it’s a miniature version of The Great Game of Business. We play in a department or workgroup but we take one of those drivers to the critical number, and we go to a department and we say, “We’re going to teach you how to put this into a game and you’re going to create it. We’re just going to teach you how to do it.” Because people support what they help create. And Stephan, I’m telling you this, the average mini-game in 2019 was $18,500 in increased profitability, the average, and that’s just the ones that I kept track of. It’s amazing because people come up with stuff you have no idea even happens every day, either saving or finding new revenue, maybe eliminating scrapper waste or the lack of productivity. The thing is when people own it, they do it.

When people own it, they do it.

So now you’ve got everything from beginning with the right leadership, you’ve shown him the purpose – the why, we start to open things up, and teach them how they affect the numbers, critical number drivers, and mini-games. Okay now, this is what I like to think of it as sort of two parallel processes, while we are as a whole organization playing mini-games and sort of learning about the numbers while the design team has to learn how to forecast and that is ugly. So we call it “poorcasting” when you start because what am I a fortune-teller? So we tell people in the design team, “Your job is not to predict the future, your job is to influence it.” So every week while everybody else is playing mini-games, for 90 days the design team will be huddling, forecasting, working on that idea of “we can control our destiny, if we control the forecast,” and at the end, we’re celebrating our win on the mini-games and introducing the huddle to everyone. So, whereas you’re going through here, you’re going. Okay, that’s a parallel process. I get it. But when we talk about the huddling and forecasting, these are your next steps in the big picture. Somebody’s going to say “What’s in it for me?” So we plug in, this is my favorite, single step of any of them, and that’s provided a stake in the outcome because I don’t know about you, Stephan, but everywhere I work before, I always knew there was some secret bonus plan, I saw Christmas vacation.

I know there’s a bonus plan somewhere. somebody’s getting it. It’s just impossible to get and I remember the first time I was involved, I got the courage to go ask, “I want a bonus, we got a new baby coming, we just bought a house, my car’s breaking down,” I’m going way back here when I was making like 28 grand a year. And it was hard because I’m going, “Any extra money would help.” So picture that, and then having the boss say, first of all, the first year I asked, they said “What bonus plan?” That’s how quiet it was in a family-owned business, there’s no boast but the second year, they knew I was working real hard, my dad raised us as kids asses and elbows that was the term around our houses, it’s all I want to see asses and elbows. So I went in there just ignorantly hammering away doing the best I could and when I finally got a bonus, they handed me a check. And I was furious, it was five grand minus taxes, the most money I’ve ever held in my hands, but I thought it was going to be 20. I don’t know if you caught that, Stephan, but I made 28 and I thought I was going to get a bonus of 20.

Without information, people will make things up and I’m not an idiot, I was just ignorant. So to provide a stake in the outcome, this is our really important step, it includes short-term mid-term and long-term rewards, but we teach you how to do a self-funding bonus. So now everybody’s got a common goal, the critical number, we base our bonus plan on the critical number. if we can reduce debt, we’ve actually increased everything good about the business, we got better cash flow, there are tons of great things. But what if you’re not in an 89:1 situation? What if you’re actually doing pretty well? Would it be great if people were forecasting their own bonus instead of waiting for you to tell him what it was? Then there’s no more of this bitching and moaning behind the scenes where it’s like, “I can’t believe that guy. He’s driving a new car and lives up in the hills,” you hear this everywhere, because I know I was that guy. I was Clark W. Griswold, assuming everything because I didn’t know anything. Do you remember that movie?

No, which movie was that?

Oh okay. That was a long time ago.

I’m just gonna ask you and all the listeners. Do you happen to remember what the premise of the movie was?

No, I don’t.

So a lot of people like going “It was a bonus. It was a bonus.” It wasn’t a bonus, he was digging a hole for a pool he could not afford based on a bonus he didn’t even know he would get. How many Clark W. Griswolds do we have in our organization every day? Don’t let him be like me, don’t let them make the stories up in their heads because it just leads to disappointment and rancor amongst your folks. But what we really want to do is when we open things up, we say, “Here’s the goal and if we hit the goal, these are the financial after-effects that we’ll get. That includes a bonus plan.” “Holy cow, now you’re talking!” Because if you said the next level, and we do it in percent of salary, so everybody gets the same percentage. So the CEO and a frontline employee can be in the same bonus plan, and all sell funding, because if it’s 6% of salary, well, obviously someone who makes more is going to get more dollars, but the percent is exactly the same, we’re all in the same game. And we show people what they did, we don’t share salary information, but we do show the bonus plan because I want someone to say “I want to earn more because I’ll get more bonus.” Next time that has people aspiring to take training, get more certification, become more qualified, and stay longer. Am I getting too excited here?

No, this is great. And so what step are we at right now?

That would be six. So seven is, keep score, where we teach you how to create your first scoreboard, so you can forecast the numbers. And then eight and nine kind of go together to keep score, that’s where we do the scoreboards, and then follow the action. That’s the huddling and forecasting and we split those into two chapters because huddling and forecasting go together. The scoreboard is about building the scoreboard and the forward-looking fashion, and so that is a simplified set of financial statements. If you will, we always start with the income statement so people can learn how simple it is that money flows through a business. And then the last step, after we learn all of these things is what we call high involvement planning. And so step 10 is literally where we create an annual renewal because each year we want to reflect on our leadership and realigned to our true north, that “why,” our noble purpose, establish a new critical number, continue our teaching of the numbers, create a new scoreboard, a new bonus plan, and that way, it’s always fresh. For nearly 40 years, Jack has been able to keep people engaged around what would seemingly be a pretty boring business, making engines and engine components, it doesn’t sound sexy, but people come from all over the world to Springfield to go through workshops into our factories, just because they can’t believe it’s real. And it’s something else I’ll tell you.

Yeah, so speaking of how real the success is, it started with an 89:1 debt to equity ratio. Give us a few milestones, where’s the business now? Where did he make the big turnarounds? Like, what was the big milestone in the late 80s, or wherever?

What a great question to ask because first of all, it wasn’t a big turnaround. They even wrote about him in Inc. magazine back in 86, about The Turnaround, because no one could believe you could come back from 89:1. But in reality, that was probably the biggest swing financially because it was so bad. And they got it to where they could actually write the ship. But Jack’s big philosophy is not rapid growth, it’s consistent healthy growth. So his goal has always been 15% a year across all the different companies, meaning consolidated under SRC holdings, which we’re all part of, and we’re employee-owned by the way. The interesting thing is, 15% a year you’re doubling every five years, so the beauty of it is consistent growth over 40 years, an easy way to look at the generation of wealth would be like this, if you put 1000 bucks in the markets back in 83, today, you’d have about, let’s say pre-COVID, you’d have about 33 grand in your account, that’s not too shabby. Warren Buffett, now he would have given you for the same thousand in 83 would have given you $400,000, huge difference. But every thousand dollars in SRC today is worth 7.6 million, it’s utterly astounding.

I talk about this every day in my life, and I’m going, “Why didn’t I find this when I was 20? Why?” And that’s why we’re doing it. That’s why we write the books and we do the speeches and go on podcasts, it is because if we can just reach a few more people. And I’d like to catch them young like my kids and say, there is so much potential, especially in the US, but so much potential in business, we just have to teach it differently. It’s not about KPIs these days, I bet you do interviews with people all the time and say, “I’ve got a new tool, and I’ve got a new system. And I’ve got a new this and a new that,” and what’s cool is we use all that stuff. In a manufacturing organization, you can’t not do lean, right? There’s always great apps. But the funny thing is, the more I meet people who are in my business, consultants keep coming up with new tools to do business, the old way, command and control, why don’t we transform it? It’s time to reinvent it and say, “Let’s reinvent capitalism while we’re at it.” What if we taught people the measures of success and expected them to do something, hold them accountable, and have them hold one another accountable, but give them a stake in the outcome? It’s a totally different conversation.

Let’s reinvent capitalism while we’re at it.

Yeah, sure is. And so you’ve been an employee-owner of SRC since the day that you joined, or did you have to earn into it over a period of a year or something?

I love your questions because they’re more insightful than most. So the real deal is that our employee ownership structure is, we are in ESOP an Employee Stock Ownership Plan, which isn’t an ERISA governed retirement plan. The difference between that and a pension is that we’re actually able to influence the value of it because it’s based on our stock price. So in 2005, when I joined I had to wait, I had to work 1000 hours and then I was allowed into the ESOP. At two times a year, you’re allowed in, and then from then on, I’ve been earning shares and driving the stock price. My whole thing is how far can we get this because it’s insane. It’s just so funny that I was just in a hamster wheel in the first part of my career and I think I was just running the rat race, doing the thing, charging up credit cards doing this and that. I wasn’t bad and I wasn’t stupid. But ignorance, that’s what we’re trying to fight here.

So you’re essentially an investor in SRC, right? But is it something that’s liquid? Normally there’s this trajectory where it eventually ends with the company going public and everybody with big piles of money walking off into the sunset. So is there a strategy here to take these 66 companies and make them all go public? What’s the endgame here?

Now you’ve gotten to step number two, the why before the how. Jack wants to transform the way business is done, in fact, he just wrote a new book if I may plug on it. It’s called Change the Game, so ours is Get In The Game. He says change the game and it’s all about stories of people from every walk of life, not for profit, for profit, healthcare, government, in higher education, all practicing the game, and the subtitle is my favorite thing in the world, “Saving the American dream by closing the gap between the haves and the have nots.” So Jack created SRC to save jobs originally, those 119 jobs we figured out it was to create jobs, create wealth, share the wealth with those who created it. So going public is not really our first thought.

I’ll tell you a few years ago, there was a special task force created because a very large equipment company that makes big yellow machines came after us and said we want to buy you and basically Jack said, “As an ESOP, we believe it or not, the trustees of an ESOP have to make the best decision for the shareholder.” Well, in our case, the shareholders are the people that work there, and there was no doubt about it. I don’t even want to make a guess at how many millions but a lot was left on the table because we could have gone private equity, we could have gone public, could have been bought out by a competitor. But we chose to stay employee-owned, and Jack calls at the price of culture, he said “We’ve done amazing things here. We don’t need to be that company.” I could tell you about different people in the energy business, in software, different people that have used The Great Game of Business through the years or some form of open-book that have created massive wealth, so much further than SRC. But what Jack has said is “We’re going to share the wealth of those who created it,” and the ESOP, the steady growth, that’s what he’s really after is how many people can we help create lives that they really want? So the American dream probably sounds a little silly but…

Not at all. Sounds a little romantic.

It is, I don’t think it’s soft either because I think Jack is probably the most competitive guy I’ve met in my life and I’ve had the privilege of meeting a lot of very wealthy individuals, but Jack will win. He goes, “Man, let’s play to win. Let’s not play not to lose.”

Very insightful. So one of the goals that you mentioned while we were kind of chatting before recording was this goal of helping 10 million small businesses?

Million lives.

10 million lives, okay.

The CEOs do not create the numbers in the business, it’s the people doing the work.

Yep, to the employees as well. It’s a specific guess, how’s that sound we go by the number of companies that we work with and that we have contact with that are actually making a move. So we estimate we’re around three and a half million right now and we still have seven years to go. We really want to make sure that we hit that number, exceed it because by going to the frontline, and I hope that term doesn’t bother anyone. I ran into someone at a conference and said, “You can’t talk about the frontline.” I’m like, “No, if business is a war, we want people in the frontline because they’re the ones doing this job, or if you want to think of manufacturing, then the frontline would be someone on the floor.” The idea though is those are the people creating the numbers in the business, the CEOs do not create the numbers in the business, it’s the people doing the work. And again, it goes for any type of work at all, because the decision to do one thing rather than another is based on, do they think like an owner? And Stephan, if you’ll allow me I should say something to everybody that’s listening that when I talk about ownership, it doesn’t mean that you have to be employee-owned.

I’m a huge advocate, I’m a huge believer, I’ve actually generated more wealth, or we have, for me in the last 15 years. If I just draw a line from when I got out of school to now, I’m dwarfing all of that. Dwarfing all of it just because the numbers are crazy, you can build so much wealth in business if you understand equity. Bottom line though, not everybody gets to do it. In the US, there are 7 to 10 million companies, something like that. Only about 7000 shares broad-based employee ownership. So we’re a tiny speck, it’s just not normal. And so a lot of folks out there are going, “I don’t think I can do that, I don’t want to do it, I’m not ready to do it, It’s just one exit strategy.” What’s beautiful about Jack is he’s going, “It’s not just about the money, it’s about lives,” so if you believe that that’s different, you can go in the employee ownership way. But everything we’ve talked about applies to anyone else, 85% of the people that practice open-book management will never share equity. It’s not in their plan. So what we’re looking at is its ownership up here, not just in the wallet. It’s an ownership mindset.

Gotcha. Now, when you shared that 10 million lives that you want to impact through what you guys are doing that reminded me of Gino Wickman, who was just on my podcast a few weeks ago, and he shared his goal, I think it was 1 million businesses or 1 million entrepreneurs or something like that. He’s trying to help entrepreneurs to get started. Make sure that they are true entrepreneurs because he’s got those seven traits of the entrepreneur. Make sure that you’re built for it because they’re only apparently 5% of the population that’s really built to be an entrepreneur. And if you are a fit, they’ll help you to step up and then succeed once you’ve made that choice.

There’s a good example, take Gino’s books, Traction or EOS and take it to the next level. If you practice that, or you’re thinking about it, or they play the great game or you do scaling up. The thing is there are different ways to approach business and operating systems, the challenge is, who’s doing it? And are we out to enrich the one or the few? Are we going to enrich the many? There’s an old saying about, “With a rising tide lifts all boats.” The funny thing is, it works and you can outpace the market by the huge factors. I mean, I don’t want to even take a guess for you. Because if I use SRC’s stock price as an example, it’s not really fair. Not everyone’s going to have that kind of performance. But the trick is, it’s all about leadership. Well, what if we taught leadership to people at every level of the business and trusted that they could learn the business?

But there’s still a wall for some reason, it’s all about command and control. I’m not picking on any particular system, they all kind of look at it the same way it’s, “We’re here, they are here. How do we get there? Oh, we’ll give them KPIs and OKRs and all of the metrics are going to be amazing,” but nobody seems to say, “Here’s how we make money and generate cash. Could you help? I’ll give you a piece.” Nobody talks about that, but the great game, so my challenge would be to use whatever system you love because then you’ll use it. Use it with discipline and then go to the next level when you’re comfortable with the business, start teaching it to others.

Yeah. Help them to be invested in your success and not just to see it from the sidelines.

Stephan, you said something really interesting earlier. You said, so you’re an investor, so to speak, in SRC. It just triggered me because that’s what most people have in their business is an investor mentality, meaning even if you don’t share equity or anything else, investors expect you to drive their stock price, owners hold themselves accountable. So that’s why we’re trying to get the ownership mindset all the way through the organization, because I don’t want to haul them all around and have them “Go, Steve, go!” I love it when I walk through one of our factories and you see somebody walking down the aisle with their name on their shirt, I’m like going “Hey, Bill, gonna get that stock price, man!” and he’ll be like, “Baker, you get out there and talk about it.” It’s just so awesome. You have a couple of thousand people behind you knowing that I might be in a lonely hotel one more night but when I talk about it, it just lights me up. And I know, they’ve all got my back and I’ve got theirs.

That’s great. So how do you teach The Great Game of Business to kids? Because kids these days are learning just the most antiquated, obsolete information in school and they’re not learning the basics of entrepreneurship, negotiation, time management. They’ll never hear the term OKRs ever as a kid in school. So how would you inspire them and deliver this kind of wisdom to the younger generation?

Well, I will tell you the one thing that unifies every business and organization around the world, in fact, when I speak, I’ll throw up a Chinese balance sheet. And it’s in Mandarin or Cantonese, or I don’t know, I don’t speak Chinese. But the amazing part is I go, “Can you read it?” and you’ll have 400 people there in a magazine conference or something and they’ll go, “No,” and I go, “Well, does it balance?” Of course, you can see it balances and go, “See that the thing is those financials that Luca Pacioli created back in 1494, any culture, language, political boundaries, geographical boundaries, it doesn’t matter, it’s all the same.” You can’t dig a well in Africa for water without it showing up on a balance sheet somewhere in the world bank or someplace. And we even started a social sector part of our business to help big brothers, big sisters and community theaters and all that.

So you’re asking me about the kids, what I want to tell you is the first thing I would do is what Jeff Evenson did, a friend of mine in St. Louis. He got $14,000 in one-dollar bills from his bank. It took two weeks to get it, he needed to order them. He took them home – and I have pictures of this, by the way, Stephan – three small kids, he piled it in the front room. He and his wife had a whiteboard with different categories of expenses, and a post-it note on each one that had a specific expense. Under the post-it note was an amount, 14 grand represented the family’s gross income. And what’s powerful about it is he made the kids count it out. And so they had to count these stacks of money, they peel off a post-it note and they’d stick it on the money and they go 1900 and whatever. So they learned about taxes-I remember my oldest when he turned 16, this is years ago, he came to me and said, “Who’s FICA?” I’m like, “This is great! A conservative is born.” No, I’m kidding. The thing is, it’s about money. I never taught him what that meant and that’s on me. So what I’m saying is Jeff went through every expense and at the end, perfect little stacks and the conversations weren’t about “I had no idea my tuition was that much.” It was “How can Susie’s pile for club volleyball be this big and mine for club soccer is this big?” Now they’re starting to care.

My kids took Dave Ramsey training in high school, it was part of their learning. What’s funny is that two of the three remember it, and I’ve really kind of connected them with those ideas because Dave’s great. We love him, he’s great with personal finance. My youngest though who’s 19, he just went through, this is his first year in college, he doesn’t remember even taking it. So what I’m saying is, you can’t teach in one lesson. So Jeff hasn’t been bringing $14,000 in one’s home all the time, but it keeps adding to, “Do you remember when we did that? Here’s something else and here’s something else.” And today, his kids are just starting college, it’s just great to hear that they understand what student loans are, what is interest, how it works. It’s a cumulative thing, Stephan, and I would say start with the basics. A lot do three piggy banks, save, give, spend, and little kids can put their nickels and quarters and dimes and that sort of thing. Just start teaching at any level, even if they’re adults and don’t stop, just keep talking about it, they’ll thank you later.

I love that example that you shared of, Jeff, with the 14,000 one-dollar bills, makes it very tangible.

That much money has a smell.

Well, these days, with those many bills, there’d be virus on that for sure.

For sure. Technically you would have a COVID pile, so maybe we don’t do it with real money, but it sure makes it an impact. What I didn’t tell you is one of the industries I was in before I came to SRC was in the Bath and Body world. So one of the things I learned in studying all about what would make a really good product and everything, is that scent is really closely tied to memory. And so that’s why when you smell something you go, “It reminds me of grandma,” or you smell something else, “Reminds me of that great day at the amusement park.” And the smell of money, he’s implanted that permanently in his kids. Every time they smell cash, I have a feeling that somewhere there’s a cog that just slips into place.

It’s not your job to predict the future, your job is to influence it. Share on XYeah, I wanna know what the smell of Bitcoin is.

No, it sounds like another podcast.

Awesome. When you were talking about the story of Jeff and the dollars, it reminded me also of a new client of mine. It’s myfirstsale.com and their premise is to be essentially like Etsy for kids, where they could make things and then sell the things. It’s a marketplace, it provides a framework for how those kids can make money as kids. So there’s just so much opportunity there, maybe there’s some collaboration that you guys could do.

It sounds good. You said something about, we aren’t teaching kids to be entrepreneurs, and I think about all the people that I know who started out mowing lawns, or some might consider menial childhood tasks but what’s interesting is that at the college level, and Jack is really passionate about this right now, we are teaching kids the wrong way to get into business and entrepreneurship. And what he means by that is, and I see it even at our own local universities, and we got five of them in Springfield. There are actually incubators that say, here’s how you do it, you go raise as much money as possible. And then you do this and you do that. The whole thing is based on debt in the beginning, right? The idea of just taking it on – and Jack started in debt – he’s like, “This is the worst thing you could possibly do,” because the way he’s gonna teach you is, how quickly can you have an overhead absorber and a cash generator. People ask him, “What’s your secret to creating so many companies?” and he just says “Those two things over and over.” Simple formula but it’s really powerful. So we just keep saying, let’s try to teach kids that business is not evil, that profit is not a four-letter word, that you can actually do good with it, in fact, you can do more good with it.

Let’s try to teach kids that business is not evil, that profit is not a four-letter word, that you can actually do good with it.

I love our social sector, we’ve been getting these letters in and emails from people in the not for profit sector and charities, but also our own Greene County government. A number of years ago, they were on the brink of bankruptcy. And when you’re in Springfield, if you’ve golfed with Jack, people will say, “Oh, yeah, I know open-book management” because apparently it works through osmosis. So if they’ve met Jack, they think they’re doing it, and Jack’s too humble to go, “You need to do this.” When Greene County, Missouri was in such bad straits, they came and said, “We need help.” And so we just put some of our coaches on it and we said, “This is where we live, this is our community, let us help.” And in a year they turned it around, there are so many great stories that I could share. When this happened, people had not had raises in more than five years. Can you imagine what that would feel like? No one knew what revenue really meant. Today, people are voting against tax levies, which is their own revenue, it’s like they didn’t connect the dots. So long story short, they didn’t raise our taxes wildly or anything they just started to implement and get everybody concerned like, “Where’s the waste?” and “Where can we get more revenue?” And how do we do this and how do we do that? They turned it around, they were able to get into position.

Now where we got a letter from Cindy Stein, our main contact with the county said that, “We would not have survived this crisis, we wouldn’t have if we wouldn’t have been set up to do so.” Well, now all of our people are working, and they’re essential for our community. And that includes the sheriff’s department and all kinds of different things you don’t think about, the street construction and all kinds of things. But the best story was a maintenance worker came up to Jack and so I just want to tell you what I did, and this is the best part about The Great Game of Business is when you get somebody who’s gotten turned on. And I think I’ve worked here for over 20 years and we use this cleaning solution, it comes in a 55-gallon drum, and when we started to learn about the money, I didn’t know those drums when it ran out a new one came. Well, now that we understood what it cost, I read the label on the side and it says dilute 10 to one. So 20 years of waste, 10 times the waste and he took pride in the fact that I found all kinds of different things. And they’re helping one another say, “Wow, what if? So, if a government can do it, oh my gosh,” your mind goes to places. What if the trillions of dollars, what if? I hope we can get some young kids turned on and say, “Let’s go make a change in all the different sectors.”

I hope we can get some young kids turned on and say, “Let’s go make a change in all the different sectors.”

Yeah, that reminds me of a story I heard from another guest, Scott Eck. He told me that when they were working on the Space Shuttle back in the 70s, I think they’re trying to figure out how to get the space shuttle under a certain weight. Well, it was overweight and it was a big problem. It was the guy at the gate who came up with the answer because he kept seeing the brainiac engineers coming in and leaving every day. There was only one person, out of that group of engineers, who was kind to this guy and actually said hello. Everybody treated him like he was just a nobody. And so one day this engineer is explaining the problem that, “We’ve tried everything, we don’t know how to get more weight off of the space shuttle and it can’t launch,” and the gate guy looks at the – I think because it’s outside – he’s like, “Don’t paint the booster rockets.”

I love it.

And so he was doing the math on that and he was like, “Oh my God, that’s it, that’s the amount of weight that fixes it.”

That is amazing. See, that’s the wisdom of the crowd, right? It’s stories like that. Or the guy who says – the truck got stuck under the bridge – “Well, let the air out of the tires,” “Oh, okay.” It’s like, “Why didn’t we think of that?” But that’s what Jack has tapped, it’s that frontline person, that middle manager, that guy who’s on the road. What are the decisions being made? They’re making it because they have no real information. They’re being told to do this, do that, but that guy at the front gate was just creative. There’s a system to tap it and to harness it rather than letting it fly off and have that guy go home to his wife every night, “I know how to do this and they won’t listen to me,” angry all the time.

Without information, people will make things up. Share on XBut I don’t think that gate guy got any money for that brilliant idea.

That’s actually a good point, but I bet he’s still gonna have a nice career at NASA, you probably got some good recognition. And he helped create an organization that would last for decades upon decades. So the thing is, does it all have to be money right now? And that’s another thing, we just spoil our kids and we need to teach people of a young age that get engaged, learn the basics, and then let’s do something new and different and awesome together. And if we can kind of beat the entitlement monster, I don’t know how, but we can do it, one person at a time. 10 million lives, we’re doing it one life at a time.

Yeah. So if folks wanted to learn this whole system, and apply it in their lives and their businesses, they don’t even have to be the business owner, they could go to the boss and present the plan. So they would start with the book, Get In The Game, and you mentioned that along with the book, there are some videos.

Yes, absolutely. You can go to greatgame.com, in fact, if you go to greatgame.com/steve there’s a sample of the book for you there, and some other goodies that are free. But in the book, Get In The Game, each step has tools, templates, exercises, so all that is free and you can get the book anywhere. The big thing is that within the system, we have courses and we have coaches all around the world. Depending on what level of implementation you want to do, you might just read the book, you might use the free resources, you might hire a coach. But we also do workshops that are virtual, we do workshops that are in person. So you come to SRC, and you actually live the experience and sit in a real live huddle and go on a tour and meet Jack. And then one of the things that we’ve created this fall as part of our contingency planning, we said, “What if there’s a big recession?” We’ve been planning on this for 10 years because we knew something was going to happen. We didn’t know it was going to be the Black Swan of COVID but if we hadn’t been working on it in the background, we recorded all of the material and we have an on-demand kind of self-directed course as well. So Get In The Game is available, do it yourself, do it on demand, do it in person, or hire a coach. All different ways, it’s very accessible.

Yeah. Well, you mentioned this black swan. So that concept is that something unpredictable and major comes to pass. But one thing that was very predictable, was the long term debt cycle. It was just a matter of time, 50 to 75 years according to Ray Dalio. He’s got a great YouTube video explaining how the economy works and explaining the short term debt cycles and long term debt cycles. We are at the end of a long term debt cycle, so of course, it’s a big downturn, and it just got kicked off because of the pandemic.

Exactly. So what’s really interesting is I recently found a video, an interview on Bloomberg with Nassim Taleb, the guy who wrote the Black Swan, did you see this? He said, “This is not a black swan, it’s a white swan. We could see this coming, in fact, I predicted it in 2007, a pandemic.” Like holy cow, I got to reread that book because this guy is smart. It’s all stuff that can be figured out right? It can all be figured out if we’re smart enough, and we understand instead of hiding in our little hidey holes, it’s getting out there and go, “What’s the reality talk to an economist read?” Something that’s more than the guide for Penny Dreadful season eight. So I don’t know what it is, get smart and make it fun. And Jack, he just took a creative guy and turned him loose with some new information, and now I just can’t shut up about it.

That’s great. It’s great to see the enthusiasm, the passion, and you’re changing lives, getting closer every day to that 10 million.

Every day and this podcast helps. Thank you, Stephan, appreciate it.

Thank you. I really appreciate you sharing all that passion and wisdom and experience with my listeners.